Overdraft disclosures: An improved model form for overdraft opt-in

Collection of prototypes: Four versions of the opt-in form, which we’ll continue testing and developing.

Before your bank or credit union can charge you an overdraft fee for most debit card purchases or ATM withdrawals, it must get your consent by having you use a form to “opt in” to pay these fees.

The challenge:

The CFPB wanted to create a form that makes it easier for people to understand what it means when they opt in for debit card and ATM overdrafts on checking accounts. The form needed to be easily printed by banks—in black and white—and fit on a standard 8.5" x 11" piece of paper.

Current form consumers use to opt-in: Banks provide this notice when an account is opened. It explains the overdraft service and its costs.

Prototype focused on comparing option: This prototype places the two options side-by-side so consumers can see where fees occur (and don't) in each of the two options. An example explains the impact of each choice on the balance of the account.

The resulting prototypes:

- Were based on user-centered design: To help us design these prototypes, we conducted in-depth interviews with more than 80 people across the country. From these conversations, we came up with four versions of the form.

- Had a stronger hierarchy and used plain language: Testing revealed how confusing this topic was to consumers and also how little of the form they actually read. As a result, we revised the structure and created clear, action-oriented headings to help guide people through the information. We moved away from bank-centric terminology, such as "our standard overdraft practices," and instead described how the two choices might affect the customer. We also tried to eliminate as much of the extraneous language as possible by exploring graphic ways to quickly indicate where fees applied, and including examples so they could see the impact an overdraft might have on their balance.

Prototype focused on explaining fees: This prototype starts by explaining fees related to overdrafts, and then compares when they will occur in each option.

My role:

- Creating and refining the structure of the prototypes.

- Simplifying the content from legal and bank jargon to plain language.

- Exploring how a print disclosure could translate to an online format that could adapt to different screen sizes and different devices.

- Reviewing and drafting questions for qualitative and quantitative testing, and convincing the research team to rethink the suggested testing protocol and instead incorporate best practices from usability testing. These changes emphasized participants’ understanding of critical pieces of the disclosure, creating more measurable differences between the disclosure options tested. It also helped further disclosure testing at the CFPB.

- Capturing feedback and synthesizing findings into suggested revisions.

Exploring the customer's pathway online: Since many customers will likely receive the revised form online, this diagram shows the steps a customer might take in accessing it. In addition to making it easy to opt in, it was important to think about the privacy concerns over when and where this online form might appear and how additional information might be accessed.

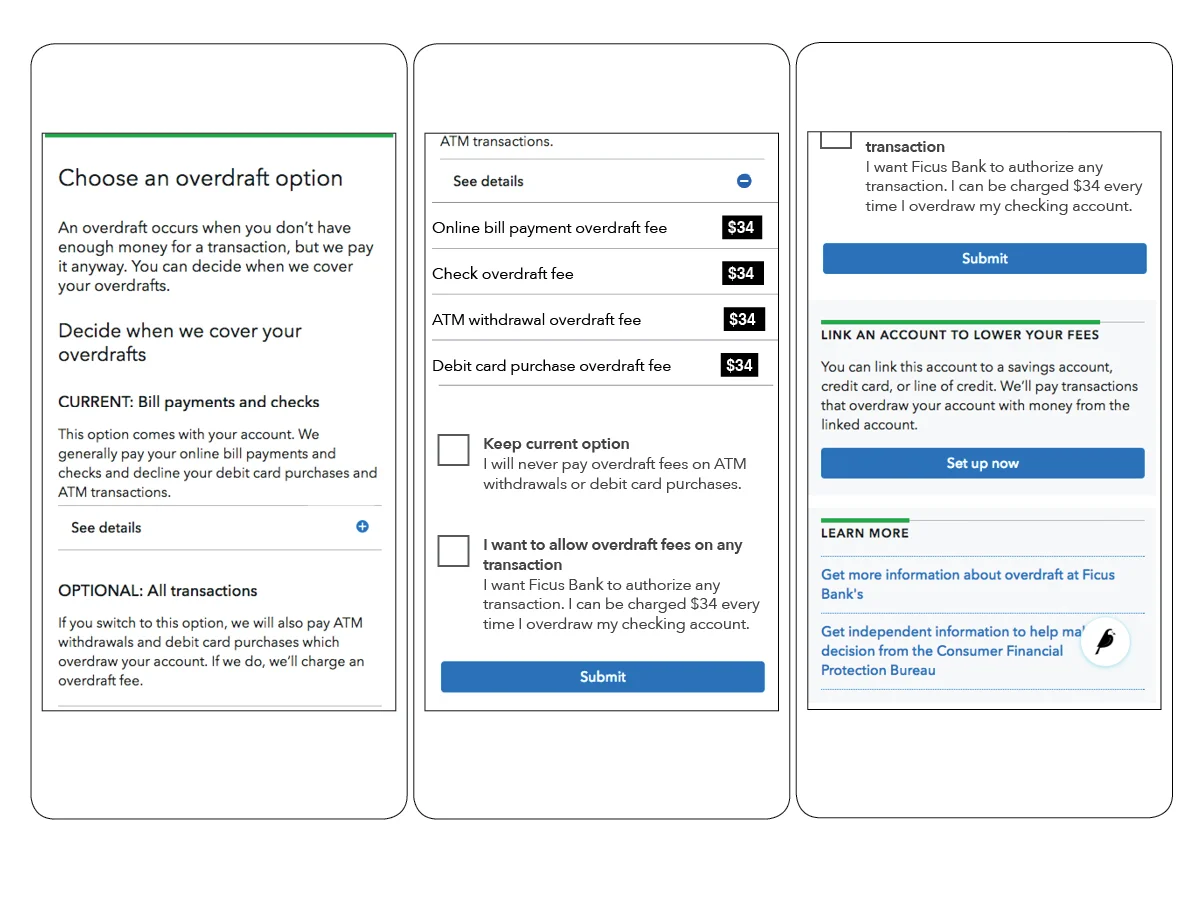

Online explorations: Using a mobile-first approach, I explored how the form could be translated to an online format. Creating a responsive prototype helped the larger team understand how the format of the form might vary in terms of order and appearance whether it was in print or on a large or small screen.