Auto loan worksheet and webpages: Materials to aid auto loan comparison shopping

Suite of auto materials: The two-page printable worksheet and both desktop and mobile views of the auto loan landing page are shown.

The Consumer Financial Protection Bureau wanted to create resources to help consumers understand the total cost of their car loans, and not just focus on the monthly payment.

The challenge:

Auto loans are the third-largest category of household debt, with almost 90% of households owning a vehicle. And, while many people shop around for the best deal they can get on their vehicles, not everybody shops for the best loan.

Focus groups and analysis of the CFPB’s consumer complaint data showed:

- Consumers focus on shopping for a particular car, not the financing.

- Consumers tend to focus on monthly payment, rather than the total cost of their loan. In some cases this results in lengthy loans that outlast the life of the vehicle.

- There is a lack of understanding about what can be negotiated, other than the cost of the vehicle.

Establishing user needs and requirements: After analyzing the research, interviewing key stakeholders and creating personas, I facilitated a workshop to prioritize user needs and build consensus among stakeholders.

The solution:

We created a suite of resources to help consumers understand: what they'll pay over the life of the auto loan, what they can negotiate when getting a loan, how to compare financing options, and how to prepare ahead of time. Together these actions can save money and reduce stress. The suite included:

Personas: Based on my own informal discussions with car-buying friends and family, as well as research conducted by the Office of Financial Education, I created personas to identify some of the key activities, challenges and needs faced while shopping for a car loan.

- A worksheet to help compare offers, calculate the total cost, and negotiate the best deal. We created a structure to make multiple math steps seem less intimidating; this was achieved by using both words and numerical examples to walk consumers through the math. The paper format was important since internet connectivity while shopping for a car may be limited, it helped consumers walk in looking prepared and confident, and it served as a low-tech and quick minimum viable product.

- A set of webpages to explain the car loan process to consumers so they know what to expect, what questions to ask, and what their rights are every step of the way.

- A printed guide for practitioners to share with clients who may be preparing to buy a car.

My role:

- Leading the discovery and interview process, including collaborating with stakeholders to identify and determine requirements and establish scope of work.

- Analyzing existing research to develop personas and job stories which articulated user needs for the wireframes and worksheet.

- Developing a worksheet structure and creating multiple wireframes to show how pages adapt for different screen sizes.

- Working on content strategy for the webpages and worksheet.

- Leading internal usability testing and planning the structure of usability testing with real car buyers. I captured their feedback and incorporated it into revisions.

- Working closely with the team including stakeholders, designers and developers.

Early sketch: Preliminary sketch focused on the need to have multiple columns for comparing loans.

The results:

Within 6 months of launching:

- 5,500 users downloaded the worksheet

- 20,000 users visited the auto loan section of the website (over 1/3 of them return again after using the materials)

- More than 8 out of 10 people are staying and engaging with the content—for close to 9 minutes

Annotated wireframes: Because these pages would become part of a responsive site, I created and annotated wireframes at multiple breakpoints (desktop and mobile are shown here).

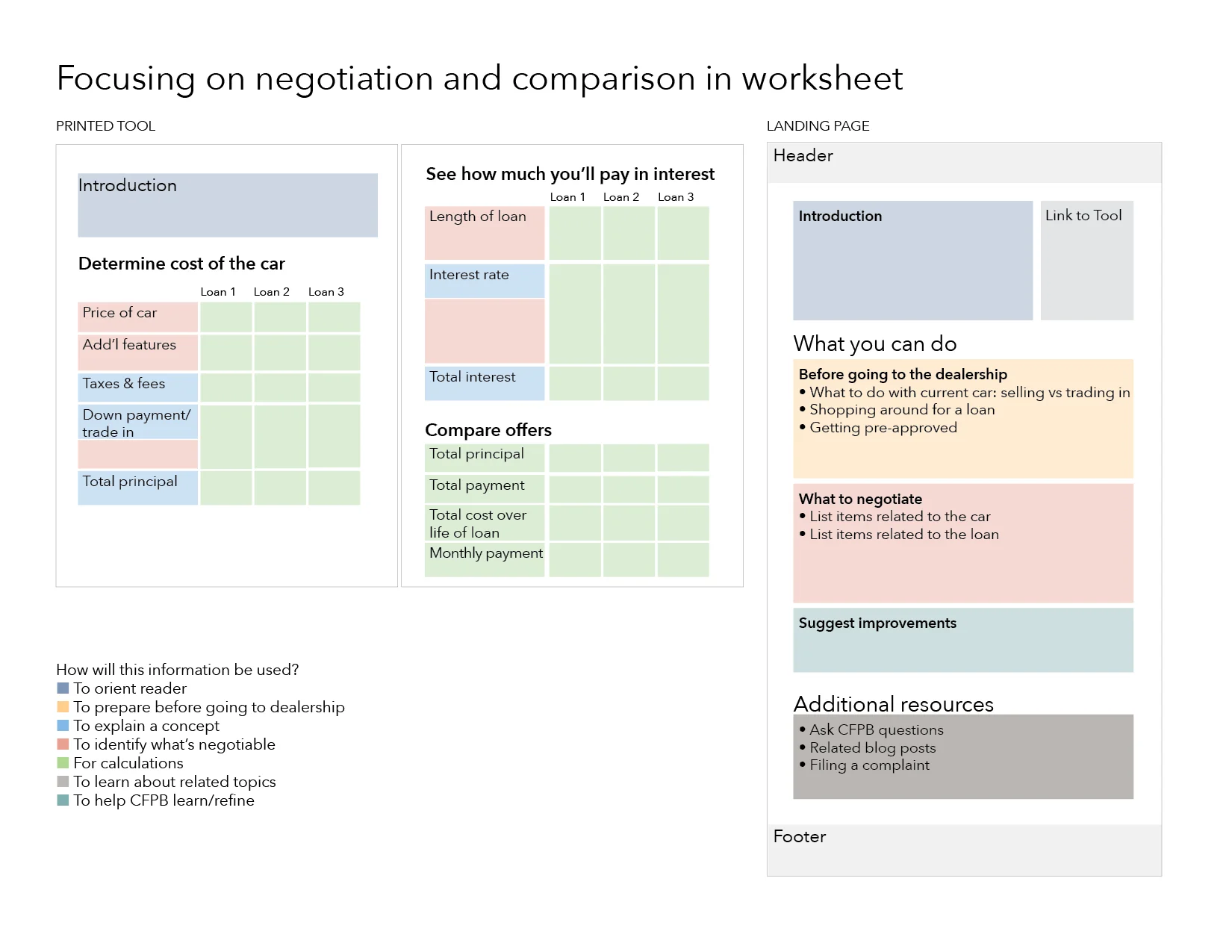

Aligning worksheet and wireframe content to user needs: In addition to creating traditional wireframes, I also color-coded the content on early drafts of the worksheet and wireframes, identifying the role of each piece of content. This helped keep the content focused on the users' needs. This visualization was helpful to the team as content was created and revised.

Auto loan landing page. The worksheet is easily accessed and downloadable at the top of the page. The rest of the page walks the consumer through the loan shopping process.

Final worksheet The first page walks consumers through calculating the cost of the vehicle and the amount they'll need to finance. The second page (not shown) helps them compare interest costs of various loans and the total they'll pay over the life of each loan.