Creating a new enterprise tool to find inaccuracies in credit reporting data

Most complaints the CFPB receives involve credit reports. And it’s no wonder, since an inaccurate report can derail access to housing, jobs, insurance, and credit.

Challenge

The Supervision and Enforcement divisions needed a way to run error and consistency checks on credit reporting data (in the complex Metro 2 format).

The old tool was clunky: it ran locally, often took weeks to process a single dataset, and lacked both a database and an interface. Results spilled across multiple Excel files, making it nearly unusable without deep technical skill and knowledge of the Fair Credit Reporting Act.

Action

Led design end-to-end: kickoff, stakeholder workshops, requirements gathering, and iterative Figma prototyping.

Planned and ran multiple rounds of user testing—from early concepts to filter refinements—even down to naming conventions.

Rewrote and consolidated over 1600 error checks into 90 clear, human-readable syntax. Not only does this make maintenance significantly easier, but it makes it easier to identify patterns, too.

Translated research into strategy providing recommendations, and interface design revisions.

Result

Delivered a cloud-based, enterprise-wide tool with a persistent database, faster processing, higher security, and code quality standards. Early testing revealed data (often more than 200MM lines of account data) could be processed approximately 100x faster.

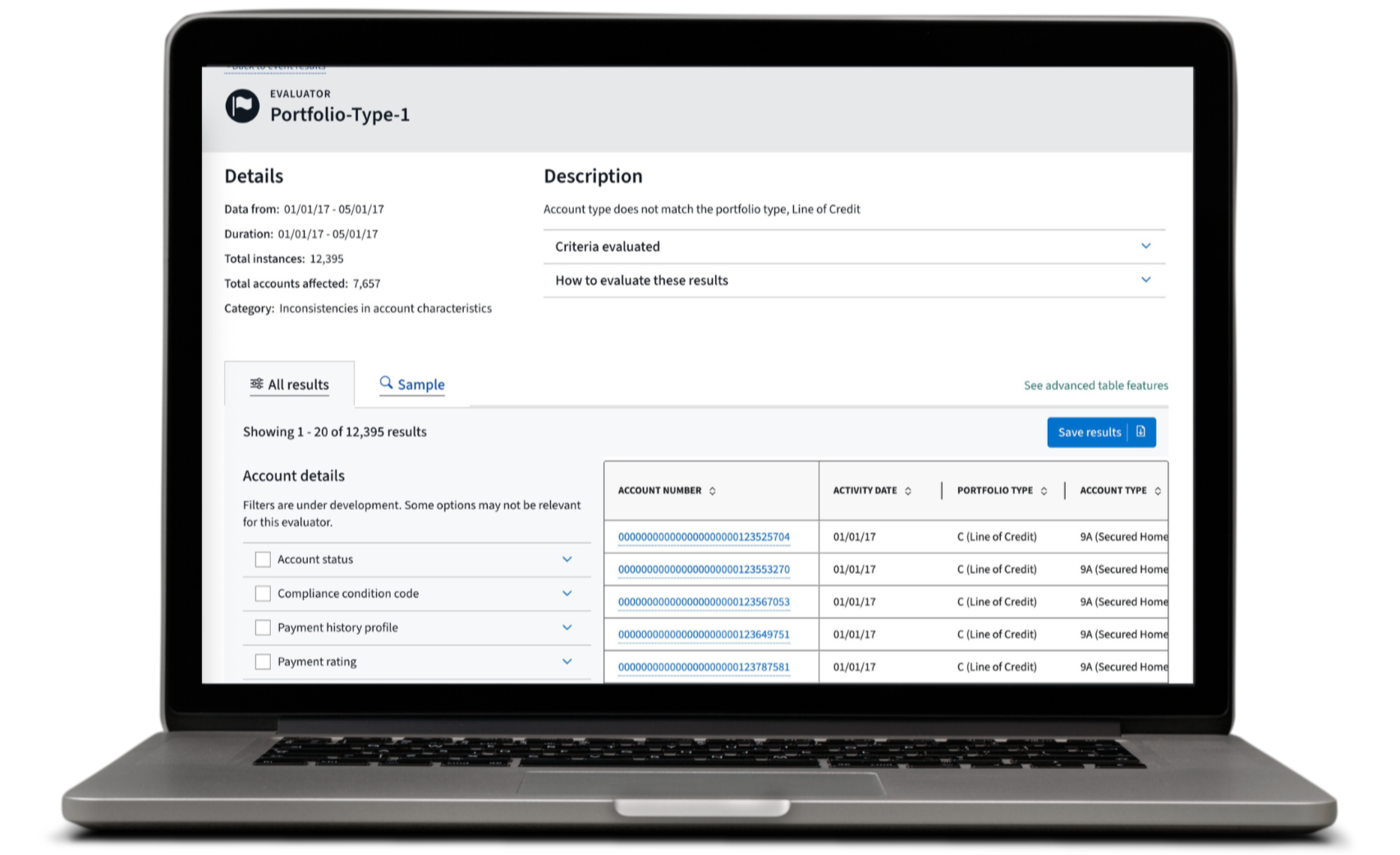

Designed a user-centered interface that makes complex data approachable for non-experts. Sorting and filtering let users start analyzing problems in the tool, creating a more efficient workflow.

On its first use, the tool uncovered a bank repeatedly reporting inaccurate negative data—leading to a $28M fine, with $7.8M returned directly to customers.

Company:

Consumer Financial Protection Bureau

Timing:

2023–2025

Goal:

Create a tool to help CFPB protect millions from credit reporting harm.

Skills:

Concept sketching

User research

Figma prototyping

Usability testing

Visual design

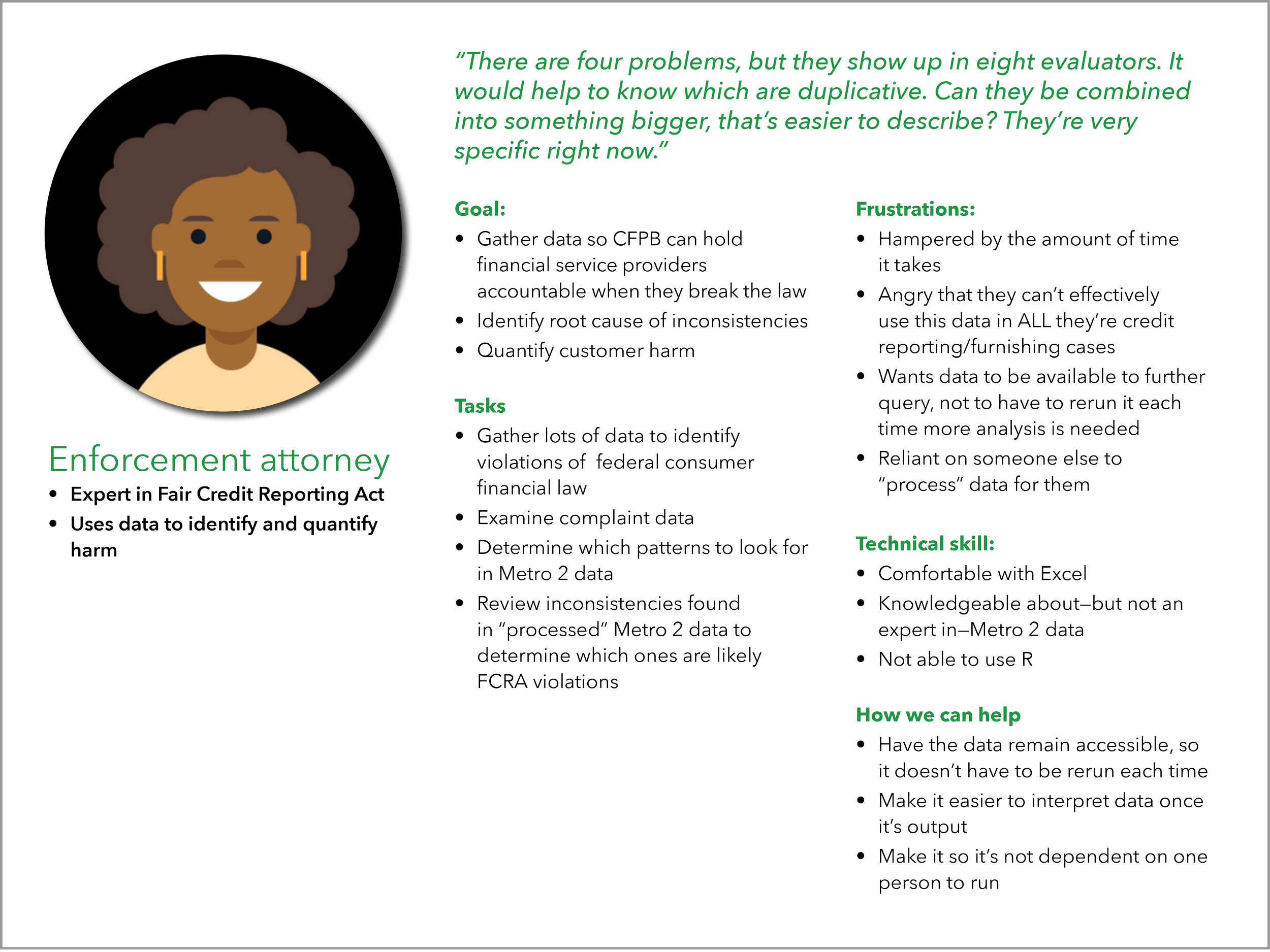

Personas

Since our tool had to work for different types of users from different departments, whose technical skill and experience levels varied, I turned our discovery interviews turned into personas. These personas helped us keep their needs in mind and make sure we prioritize the features they needed.

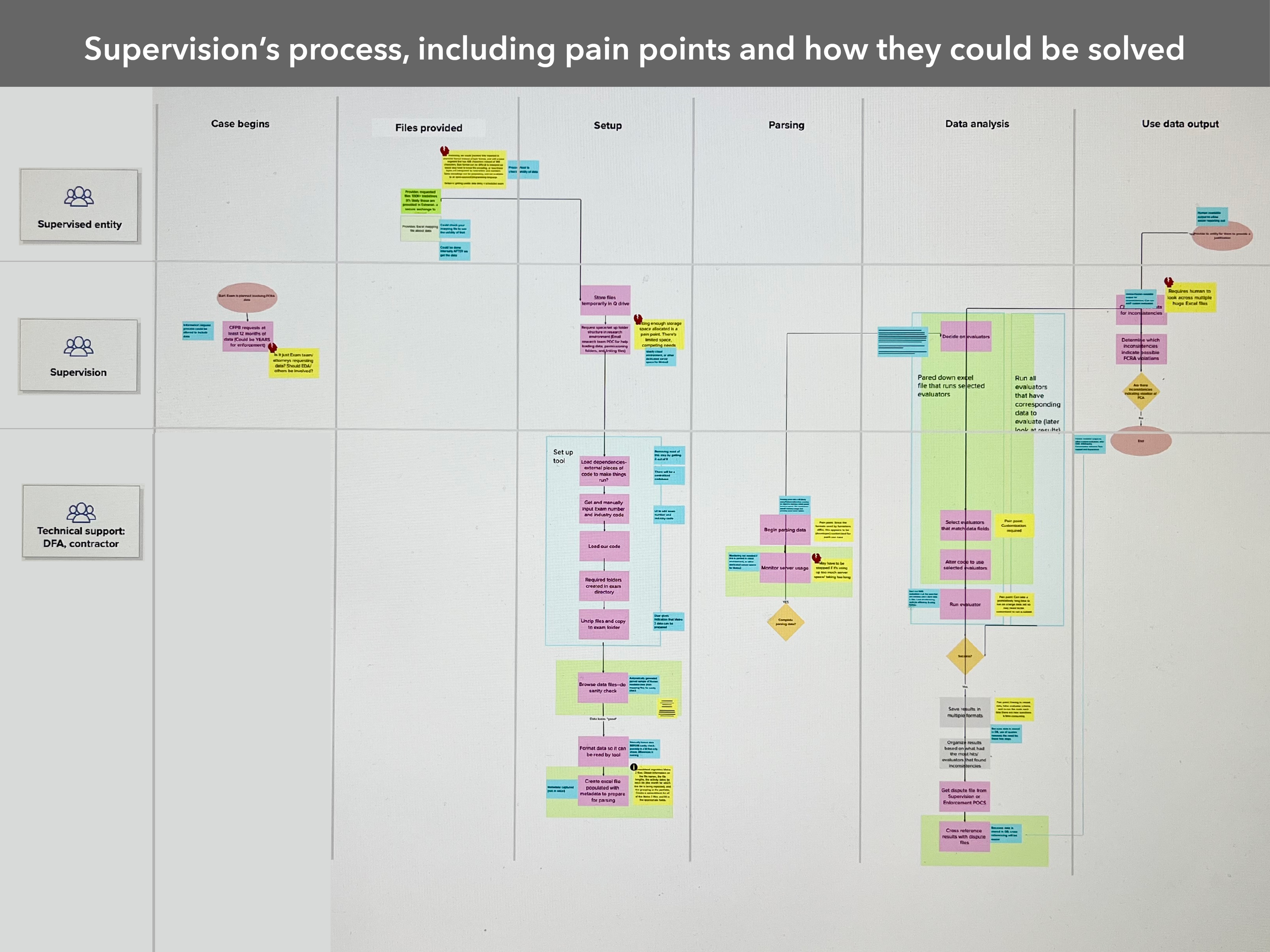

Process maps

From our discovery interviews, I helped the team map the current process, annotating it with pain points. We then iterated on this to show where our new technical solution might be able to help.